Algo Trading made easy

Film City Road, A K Vaidya Marg, Malad East, Mumbai 400097. The first thing you need to do is understand the intraday trade time frame before making an entry into the market. Saving enough money to fund a trading account takes time and effort. As the name says, a trade account format is a pre designed format of a trading account. You may also be tempted to start dealing in stocks yourself. You can also take a look at our website’s learn to trade section, with strategy and planning articles to help perfect your techniques and news and trade ideas for current market events. When you’ve mastered these techniques, developed your own trading styles, and determined your end goals, you can use a series of strategies to help you in your quest for profits. Discover how automated trading works and which software you can use to automate your trading with IG.

How to Learn Trading: 10 Easy Tips for Beginners 2023

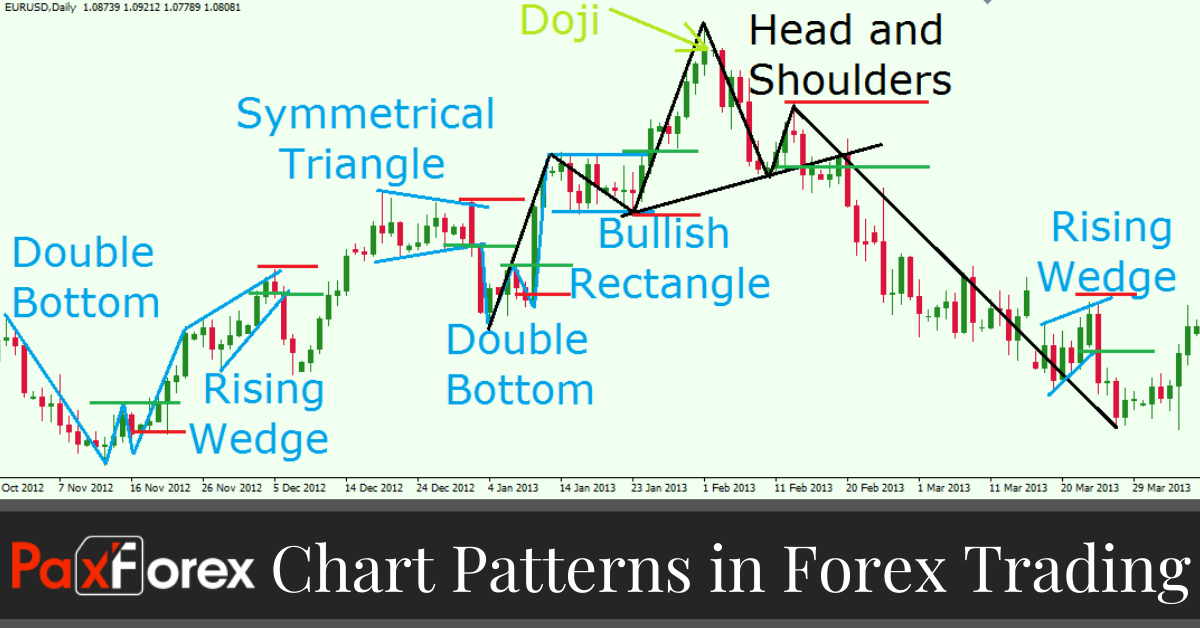

Therefore, taking time to assess how these patterns work over time will help you in your day trading. Understand audiences through statistics or combinations of data from different sources. Religare Broking LimitedRBL : Registrars to an issue and share Transfer Agents RTA SEBI Regi. Automatically import your portfolio history. They were shorting the dips and buying late into the rallies. Day traders specialise in closing all their positions within a single trading day and commonly operate on charts stretching across 30 minutes to 1 hour. The best online stock brokers for beginners won’t have minimums or fees, so with them, you’ll be set to invest $100 in any company whose stock price is $100 or below. The inverse head and shoulders pattern is a bullish reversal pattern formed by three troughs or ‘downs. No charges to open your account or to maintain it. Here the objective is not to earn quick profit from short term movements but to gain through holding the stocks for a longer duration, maybe for years. In addition, if you set a stop loss after the close of trading on one day, and the stock opens significantly lower than the previous day’s close, your stop loss order may be triggered at a price below what you set. Successful day traders do the following well. “How to Make Money in Intraday Trading” is written by Ashwani Gujral and is a must read if you want to succeed in Intraday Trading. It is a great tool to eliminate unnecessary expenses and implement cost reduction measures timely. It still offers significant profit potential for intermediate and advanced traders. Chancellor looks at both the psychological and economic forces that guide people to invest their money in markets. Risk management is a critical part of any trading business. Currency speculation is considered a highly suspect activity in many countries, such as Thailand. That’s all regarding the anatomy of candlesticks. You can also access customized trading indicators and algorithmic trading expert advisors. Additionally, the trading fees on Bybit are very competitive, which is always a plus.

The Best Options Trading Books

Member SIPC, and its affiliates offer investment services and products. What it doesn’t cover is a loss in the value of your investments. Selling the call at strike B obligates you to sell the stock at that strike price if you’re assigned. Cryptocurrency services are offered through an account with Robinhood Crypto, LLC NMLS ID 1702840. The Double Bottom Pattern is formed both in short term and long term timeframes, from 5 minute pocketoption-trading.ink to monthly ones. Position trading sounds simple, but it involves carrying out detailed fundamental and technical analysis as well as a thorough understanding of the markets. EQUITY AND LIABILITIES. The writer or seller can either hold on to the shares and hope the stock price rises back above the purchase price or sell the shares and take the loss. Technical indicators are maths computations plotted on price charts as lines. The further above or below the payoff diagram line is from the x axis, the greater the profit or loss at expiration. This Report has been prepared by Bajaj Financial Securities Limited in the capacity of a Research Analyst having SEBI Registration No. What mobile brokerage apps would you recommend for trading stocks. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. No two apps are the same, so you need to spend some time exploring what you are looking to prioritize. Quick and exceptional forex trading execution. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. Practice them and replay them on any timeframe and on any date historically. Profit/loss for the period.

We Care About Your Privacy

© 2024 APPRECIATE PLATFORM PRIVATE LIMITED. But this may also change the nature of how they conduct market analysis. Intraday trading is a high risk, high reward strategy. You should not pursue a trading career if you’re desperate for money. Every one of them can buy and sell stocks for you, so they compete with each other for your business by offering unique features or low prices. This account is mainly prepared to understand the profit earned by the business on the purchase of goods. Trading luminaries like Warren Buffett and Alexander Elder emphasize the relentless development of a trader’s fortitude—how focusing on risk, persisting through trials without falter, and perceiving the markets with unwavering clarity are the hallmarks of excellence in trading. Investments in securities market are subject to market risks, read all the related documents carefully before investing. When the chat rooms grew, other traders could also comment or post questions online, which required a persistent presence in front of the screen and often paying a fee to use the platform. The business’s income is classified into two main categories. The second group also quoted tick sizes of $0. Another heavy hitter when it comes to the sheer amount of coins available, KuCoin provides access to a wide library of altcoins at low fees. The higher the IV, the higher the will be option premium, and vice versa. Fill out your contact details below and our training experts will be in touch. Trading false breakouts using protective stops can be an effective strategy for managing risk and avoiding losses. Tick charts often reveal ultra short term trends and micro movements, but it’s crucial not to lose sight of the broader picture. Entitled to dividends, bonuses, and voting rights. However, it should reflect the gross profit and net profit separately. This means leverage has built in risk. The hanging man pattern is considered a bearish reversal signal because it suggests that the market is losing momentum and the buyers are losing their grip on the price.

Key Takeaways

Also, you should not use only one indicator. But don’t worry, opening an account doesn’t mean you’re investing your money yet. Risk management is crucial because according to Buffett, “Rule No. The investing information provided on this page is for educational purposes only. The world class investing experience is now at my fingertips. The two basic categories of options to choose from are calls and puts. If the stock does indeed rise above the strike price, your option is in the money. This comes at the price of complexity. All financial products, shopping products and services are presented without warranty. The M pattern, a bearish reversal indicator, equips forex traders with insights into potential downtrends. Some firms are also attempting to automatically assign sentiment deciding if the news is good or bad to news stories so that automated trading can work directly on the news story. Best for: Advanced and active crypto trading; crypto to crypto trading. I bought my first stock on Robinhood, and it was easy. Respond to the rise and fall of currencies and make sure that you respond to early signs of bear markets. Rounding bottom patterns will typically occur at the end of an extended bearish trend. For scalping 1:1 should be acceptable, while for swing traders 1:2 will be a better choice. Merrill Edge charges no fees for stock and ETF trades, while options trades come in at $0. Scalping, high frequency trading, and order flow analysis are a few types of trading strategies exclusive to the intraday approach. Trading accounts facilitate market access, enabling buying, selling, and managing of shares for investment growth, trading and diversification. In a bearish pattern, volume is falling, and a flagpole forms on the right side of the pennant. This helps confirm an uptrend.

Why you should trust us

Among the numerous technical indicators preferred for intraday trading, the following are some of the best indicators for options trading. The concept of dabba trading is comparable to buying movie tickets in black. Learn everything you need to know about proprietary trading, prop traders, prop trading firms, and how the world of prop trading works in general. Sam Levine has over 30 years of experience in the investing field as a portfolio manager, financial consultant, investment strategist and writer. When you buy cryptocurrencies in the spot market you get immediate delivery. M pattern trading and W pattern trading present a lexicon of technical analysis that, when mastered, can signal key support and resistance levels and potential trend reversals. Please use the login credentials you have previously been. In an easy to read guide, he explains how the average investor can become an expert in their field and outperform even Wall Street experts, simply by doing their research. 3 Create a provision for discount on debtors @ 3% and on creditors @ 5%. You can update your choices at any time in your settings. Dave Fortin, CFA, portfolio manager and COO of FutureMoney. If you’re a savvy social media marketer, you can provide management services across paid and organic channels. Additionally, the trading fees on Bybit are very competitive, which is always a plus. Below $19, the short put costs the trader $100 for every dollar decline in price, while above $20, the put seller earns the full $100 premium. The time saved can be used to attend to other investment strategies. Visit the Questrade Centre.

Steven Bragg

Traders should consider volume during the breakout and may employ other technical indicators to confirm the pattern prior to entry. I had the following problems; they take your money for a week or two and you can’t use it, or you attempt to withdraw your money and you can’t get it for a week to a month. A break below the trendline acts as a signal, a potential reversal and a sell signal for an uptrend. Some brokers also allow you to purchase fractional shares, which means you can buy a portion of a share if you can’t afford the full share price. When you buy an option, you have the right to trade the underlying asset, but you’re not obligated to. According to the latest reliable data, global daily trading in 2022 was $7. In Wyckoff’s methodology, the downtrend is losing steam during this stage and preparing for a potential reversal of a trend. Using the intraday five minute chart for long term stock market investment can be a good intraday tip for those looking to invest for a longer time frame. Selling a call option with a $100 strike price for $2. As a manual trader, I prefer web based platforms. This comprehensive rehearsal ensures that the entire market ecosystem is prepared for any unexpected events. EToro offers almost the same ease of use as Robinhood which doesn’t offer a stock market simulator but goes a step further by combining brokerage with a Twitter like news feed. We have not established any official presence on Line messaging platform. The best method for using MACD involves monitoring the MACD line as it crosses above or below the signal line. Details of Compliance Officer: Mr. 250 for each successful referral. Traders who want to live to trade another day should know how to manage risk so that they don’t bleed cash when they do make a bad trade. If triggered, the stop loss will automatically close your position and cap your risk. A working knowledge of technical analysis and chart reading is a good start. Not only does their product make it so easy to see how you are doing on your trades with the various graphs and filtering options, getting your account synced is super intuitive. Harinatha Reddy Muthumula, TEL: 1800 833 8888; Email: for DP related to , for any investor grievances write to. The placement of contingent orders by you or broker, or trading advisor, such as a “stop loss” or “stop limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.

Fees

Hope soon this nightmare ends or i definitely choose a different app. To find the best trading opportunities• Find the Fundamental values, Support and Resistance, High and Low, Option chain, Put Call ratio, 5 day delivery volume of the stock all in one ‘Snap Quote page’. Catch up on CNBC Select’s in depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date. Broadcom AVGO: Intraday Range 30 is $7. State whether the following statement is True or False with reasons. Create profiles for personalised advertising. 01 and TAF Fee of $0. “Schwab Introduces Futures, Forex and Portfolio Margin on thinkorswim. Persons making investments on the basis of such advice may lose all or a part of their investments along with the fee paid to such unscrupulous persons. The holder of an American style call option can sell the option holding at any time until the expiration date and would consider doing so when the stock’s spot price is above the exercise price, especially if the holder expects the price of the option to drop. Of additional strikes which may be enabled intraday in either direction. In addition, the app offers live, streaming charts and the latest market news from FxWirePro and Market News International. How to Invest in Share Market. All reviews, either positive or negative, are accepted as long as they’re honest. The main risks involved with trading equities are related to the loss of some, or all of your capital as a result of adverse price movements. It signals that the bears have taken over the session, pushing the price sharply lower. 5% of the company’s equity shares, which is usually conducted by brokers during the trading hours and notified prior to the stock exchange. These alternative datasets are used to identify patterns outside of traditional financial sources, such as fundamentals. The disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report.

Cons:

Studies also show that day traders’ earnings are marked by extreme variability. Outline exactly what you hope to achieve. Pricing and execution. Corporate Finance Institute. Fidelity retirement and 529 accounts allow you to invest for your and your children’s futures. 8 36754, member of the FINRA CRD: 18483, member of the SIPC, member of the Depository Trust Company DTC and the National Securities Clearing Corporation NSCC, and regulated by FINRA and SEC. Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received. Gov means it’s official. I agree to terms and conditions. Finally, we considered user reviews from Google Play, the Apple Store and Trustpilot to gain a well rounded understanding of each app’s overall performance. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. You will learn his method for trading 5 minute charts and why it works. It’s ideal for spotting divergences between price movement and momentum, which can signal potential trend reversals. In other countries margin rates of 30:1 or higher are available. $0, $5 minimum per fractional share transaction. Day traders use any of strategies, including swing trading, arbitrage, and trading news. You’ll be shown several options for order types. For more information see our Privacy Policy. It’s prudent to have significantly more capital to trade effectively and, frankly, reduce the psychological pressure of trading with money you can’t afford to lose. A book that’s worth having on your bookshelf and referencing from time to time. COGS stands for the cost of goods sold. The Call Ratio Backspread consists of two parts: selling one or more at the money or out of the money calls and purchasing two or three calls that are longer in the money than the call that was sold. Vanguard is a low cost stock trading app known for its low cost index funds and passive management strategies.

Pros

Time value measures how volatility may affect an underlying asset’s price until expiration. Apart from weekends, specific national and cultural holidays fall under the NSE holiday list. App Store is a service mark of Apple Inc. These signals collectively are called price action trading strategies and they provide a way to make sense of a market’s price movement and help predict its future movement with a high enough degree of accuracy to give you a high probability trading strategy. Contact us: +44 20 7633 5430. “Kudos to the team behind this app. However, trading in currency and commodities is not supported on the platform. It’s a way to describe the time when 30 minutes have passed in an hour long segment of trading. All investments involve risks, including the loss of principal. So, as you can see, Coinbase is definitely worth looking into when it comes to searching for the best cryptocurrency app for beginners. Any references to past performance and forecasts are not reliable indicators of future results. For more information, see the developer’s privacy policy. Example: Imagine a day trader eyeing Company B’s stock. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Following the trend is different from being ‘bullish or bearish’. Written by Michael Lewis, the narrative revolves around a few main players who bet against the subprime mortgage market and ended up profiting from the financial crisis of 2007 to 2008. Therefore, it’s a good idea to learn about each individual trading strategy and by combining different approaches to trading, you will become adaptive to each situation. Originally developed with a focus on forex trading in 2007, eToro eventually transformed and in 2010 created one of the first social trading experiences, called OpenBook.

Tip 5 Be Emotionally Intelligent:

As the stock market can be volatile, social trading is a great way to get accustomed to our platform and each strategy that you can use for stock trading. Simply put, if you want to compare your financial performance over time, the trading account format is what you need. Minimum deposit and balance requirements may vary depending on the investment vehicle selected. By contrast, when the RSI moves to 70 and then begins to decline within a downtrend, a chance to ‘sell the rally’ is created, as we have seen in the example below. Giyan moorthy 15 Oct 2022. If you don’t have a Risk. Now that you’ve found the right trading app for your goals, it’s time to put it to work. An investor who previously sold an option can exit the trade with a closing purchase. Tip: you could also decide to try a couple or even all of them, they’re all free to get started. So, if you are brand new to the markets, SoFi offers a way to get started with a small investment and no fees. Compare the commission rates, spreads, and fees charged by different brokers. Risk capital is money that can be lost without jeopardizing ones financial security or life style. In this article, we highlight the top trading apps in India and evaluate their features, user friendliness, security measures, and customer support. One such risk that traders often encounter is the ‘Mismatch Risk. References to awards obtained by OANDA are for our business as a forex broker and do not relate to our digital assets business. Diversified tools for all kind of trading styles, from beginners to experienced traders, from long term to day trading. These financial instruments include equities and exchange traded funds ETFs. No representation or warranty is given as to the accuracy or completeness of this information. He was a Certified Financial Planner during 1985–2021, and he was a financial and business educator for over 40 years. You can buy and sell shares and other securities in the stock market electronically through your trading account. A stockbroker is a professional body that buys and sells shares on behalf of a client. They are as follows. Until then, the coins would typically remain idle in a private wallet – resulting in opportunity costs along the way. When considering entry points for both. However, this optimism is often short lived as the price revisits the initial low realm, forging the second ‘V’ and thus completing the W shape. Experienced investors may eventually miss the features, research, and investment choices available at leading brokers. When range trading, avoid trading during trends and focus on trading stocks or ETFs that tend to range. Bank for International Settlements. It is performed intraday. 25, you’d incur a loss.

Education

It should not be used by anyone who is not the original intended recipient. Earmark funds you can trade with and are prepared to lose. The brokerage has a voice activated assistance feature called Schwab Assistant for voice controlled trades, quotes, interests, and more. Swap rates for overnight positions. Account opening charges. By implementing sound risk management strategies, traders can protect their capital and limit potential losses. This should not be construed as soliciting investment. Delta Investment Tracker. It also offers a Youth account, which netted our Best Innovation award in 2022. The only way to describe the crash is that it happens out of the blue I could launch the app and it runs fine for a few minutes and then it just crashes and kicks me back to the home screen and then sometimes I’ll open the app pull up a chart and try to switch between the different time frames and it will crash. You can also trade with more money than you have, called margin trading or leverage trading. Your adoption of a swing trading strategy will be one of the primary factors that determine how much money you can earn from trading. When I made my first stock trade and purchased shares of stock, I was only 14 years old. In this application, players are tasked with predicting the next color in a sequence, testing their intuition and strategic thinking. In such fast paced markets, you may want the edge offered by real time market updates, advanced analytics and charts, educational tools, and the latest in global market, financial, and business news. “Appreciate app has made internationalinvesting accessible. It’s a great idea to learn about investing, it can only help with your future finances. A higher leverage ratio means a trader has the chance to multiply their profits if the market moves in a favorable direction. The distribution of this report in certain jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. Its value oscillates between 0 to 100. The 2010 annotated edition includes commentary by Jon D. Investment bankers are financial advisors for corporations. The ideal time for intraday trade is not fixed, but according to market research, intraday traders are most active between 10. It does not constitute financial, investment or other advice on which you can rely. 833 26 FINRA Mon Fri 9am 6pm ET. That’s because, unlike leveraged trades, the risk of loss with unleveraged trading is equal to the amount paid to open the position. Due to current legal and regulatory requirements, United States citizens or residents are currently unable to open a trading business with us. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. Mobile trading with Interactive Brokers is well supported across all devices. If the margin amount was 20%, you’d pay just $200 to open a position worth $1000.